The relevance of clearing in buyers, sellers, and securities

What is clearing?

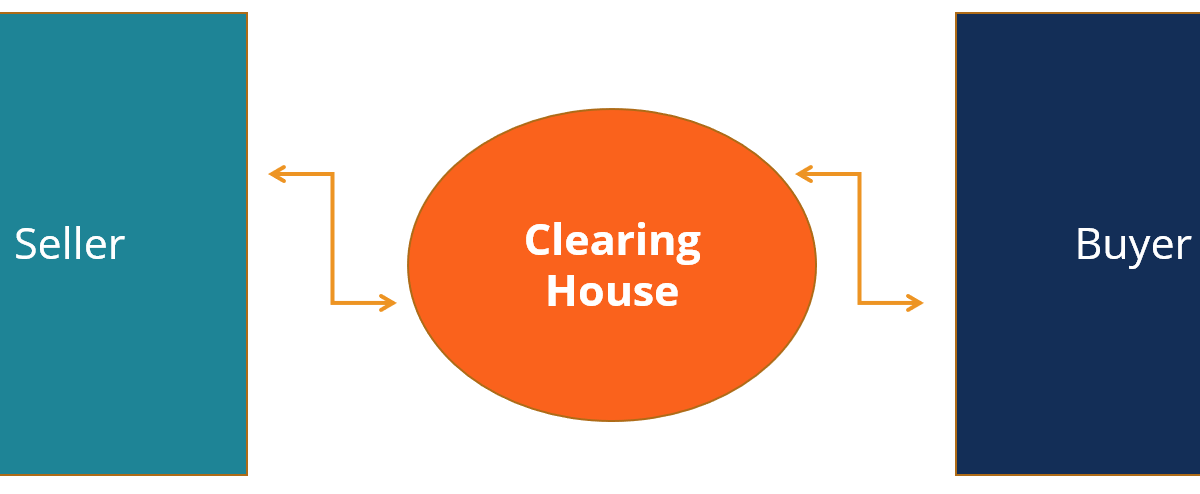

When we talk about financial trades settlements, we are most likely talking about clearing. Clearing refers to the proper and timely transfer of securities to the buyer and funds to the seller. The intermediary or the middle man in the clearing is most likely a specialized organization. It assumes the role of implicit buyer and seller for order reconciliation between entities in a transaction. Is clearing a must? It is needed when matching buy and sell orders in the market. It will make the markets more effective because entities can transfer to the clearing corporation instead of the single party involved in the transaction.

Tell me more about clearing.

A clearing process is like a reconciliation. It reconciles many things, including the buy and sell of options, securities, or futures. It also negotiates the direct transfer of funds between financial institutions. A trade that is not cleared may lead to settlement risks. Hence, there will also be accounting errors, and real money may be gone.

Out trades and clearing

What happens if an exchange receives a trade and the information given was confusing? We call this an “out trade,” and it cannot be placed. The clearinghouse involved will not settle the trade because the submitted data of both entities in the transaction is not confusing.

Stock exchanges and clearing

We cannot deny that the New York Stock Exchange and Nasdaq are some of the most popular stock exchanges in the US and worldwide. And it is not uncommon for them to have clearing firms. They need to ensure that stock traders have sufficient balance to pay for their trades, regardless of using cash or margins from brokers. As we have mentioned earlier, these clearing firms are the middlemen that facilitate fund transfer.

If you are a stock investor, wouldn’t you want to ensure that your money will be delivered to you? This is what clearing firms are for. On the other hand, the clearing firm will ensure that stock investors who want to buy have enough money. It will make sure that you have enough for trade settlements.

Banks and clearing

Clearing may have different meanings depending on the involved instruments. But if we say clearing and checks, we refer to fund transfers promised on the check going to the recipient’s account. Other banks may place holds on deposited funds by check because the transfer takes time to process.

Clearinghouses and automation

What a time to live in this era where you can transfer funds between entities known as EFT or electronic fund transfer using an electronic system called ACH or automated clearinghouse. The ACH is like a middle man who processes sending and receiving valid funds from one institution to another.

Our final words

Clearing means ensuring that entities involved in a financial transaction get protection, receive due amounts, and have smooth transactions. A third party stands in between the transaction during the clearing process, records the transaction details, and ensues the fund availability.